On March 4, 2020, CBP issued CSMS #41898289 – UPDATE: Section 301 EU LCA Modification – Effective March 05, 2020, which provides information and guidance on USTR’s modification of the Sec. 301 additional duties on products of the EU or its member states. It is reproduced below:

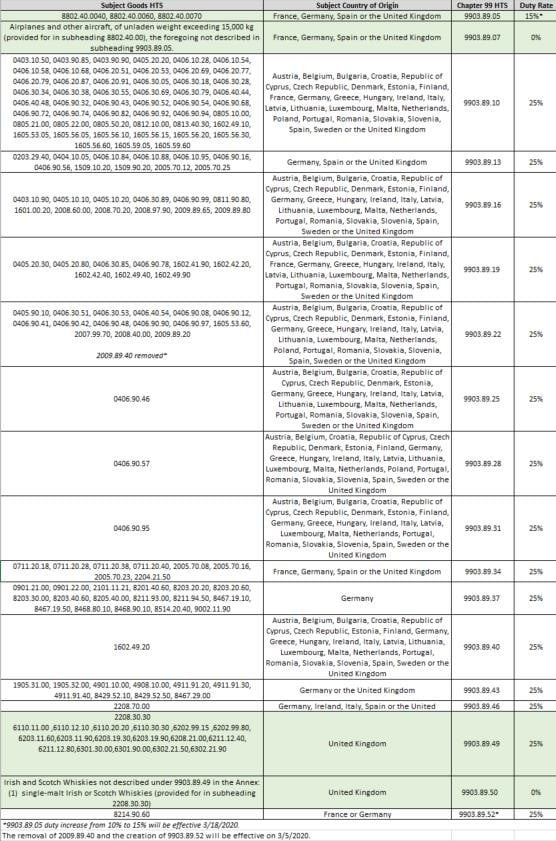

The purpose is to provide notice of the United States Trade Representative’s (USTR) modification determination to impose additional duties on products of the European Union (EU) or certain member states. There are two effective dates: on or after 12:01 a.m. eastern daylight time March 5, 2020; or on or after 12:01 a.m. eastern daylight time March 18, 2020. The complete list of affected products, countries of origin, Chapter 99 HTSUS numbers, and the associated effective dates and tariff rates is attached to the end of this memo.

BACKGROUND:

Effective October 18, 2019, the USTR imposed additional duties on certain products of the EU and certain EU member States in this Section 301 investigation to enforce U.S. WTO rights in the Large Civil Aircraft (LCA) dispute. See 84 FR 54245. On December 12, 2019, the USTR announced a review of the Section 301 action and requested public comments.

On February 21, 2020, based on this review, the USTR published a Modification to the LCA dispute in 85 FR 10204 to revise the action being taken by increasing the rate of additional duties on certain LCA, and by modifying the list of other products of certain current and former EU member States subject to additional 25 percent duties.

As specified in the annexes to FR notice 85 FR 10204, the USTR has determined to increase the duties on certain LCA from 10 percent to 15 percent. The countries that are affected by the duty increase for LCA are France, Germany, Spain or the United Kingdom.

The USTR has also changed the composition of the list of products subject to additional duties of 25 percent. Specifically, the USTR has added one product of France or Germany, classified under HTS subheading 8214.90.60, and removed products classified under HTS subheading 2009.89.40.

GUIDANCE:The modifications set out in Annex 1, subparagraphs A and B are applicable with respect to products that are entered for consumption, or withdrawn from warehouse for consumption, on or after 12:01 a.m. eastern standard time on March 5, 2020. The modifications in additional import duties for products set out in Annex 1, subparagraph C, apply to merchandise entered for consumption, or withdrawn from warehouse for consumption, on or after 12:01 a.m. eastern daylight time March 18, 2020. A complete list of products subject to the remedy and assessed duties are set out in FR notice 85 FR 10204.

ADDITIONAL INFORMATION: Any product listed in Annex 1, except any product that is eligible for admission under ‘domestic status’ as defined in 19 CFR 146.43, which is subject to the additional duty imposed by this determination, and is admitted into a U.S. foreign trade zone on or after 12:01 a.m. eastern daylight time on March 5, 2020 or March 18, 2020 (dependent on the subparagraph in which the product is listed) may be admitted as ‘privileged foreign status’ as defined in 19 CFR 146.41. Such products will be subject upon entry for consumption to any ad valorem rates of duty or quantitative limitations related to the classification under the applicable HTSUS subheading.