On October 17, 2019, CBP issued CSMS #40281968 – Additional Duty on Products of the Countries of the European Union Under Large Civil Aircraft Section 301 Trade Remedy Action, which is reproduced below:

BACKGROUND

The U.S. Trade Representative has determined that the EU and certain member states have denied U.S. rights under the World Trade Organization (WTO) Agreement and have failed to implement WTO Dispute Settlement Body recommendations concerning certain subsidies to the EU large civil aircraft industry.

On October 9, 2019, the U.S. Trade Representative published in the Federal Register 84 FR 54245, a Notice of Determination and Action Pursuant to Section 301: Enforcement of U.S. WTO Rights in Large Civil Aircraft Dispute. The notice announces the U.S. Trade Representative’s determination to impose additional duties on products of the EU or certain member states. The Large Civil Aircraft Section 301 duties only apply to products of the countries set forth in 84 FR 54245, and are based on the country of origin, not country of export.

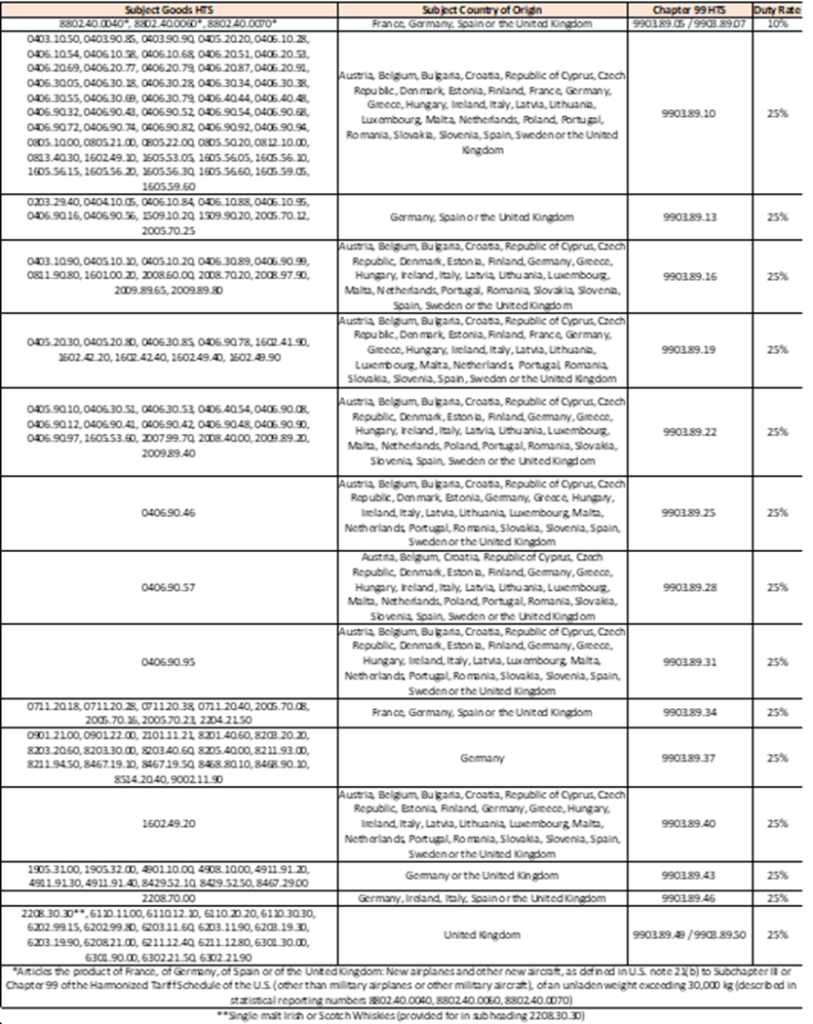

The affected countries are Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden or the United Kingdom. Additional duties imposed are effective on or after 12:01 a.m. eastern daylight time on October 18, 2019. These products are subject to either 10% or 25% additional duties.

A complete list of products subject to the remedy and assessed duties are set out in Annex A to 84 FR 54245. Annex B to 84 FR 54245 contains the same list of tariff subheadings, with unofficial descriptions of the types of products covered in each subheading. For ease of reference, a link to the entire Federal Register Notice, which includes Annex A and Annex B is embedded in this message.

Technical changes required to implement the intended scope of the Large Civil Aircraft Section 301 trade remedy and to correct other errors are included in the Federal Register Public Inspection Document Number 2019-22902 at https://www.federalregister.gov/documents/2019/10/18/2019-22902/technical-adjustments-to-section-301-action-enforcement-of-us-wto-rights-in-large-civil-aircraft.

The Large Civil Aircraft Section 301 duties only apply to products of the countries set forth in 84 FR 54245, and are based on the country of origin, not country of export.

GUIDANCE

The increase in additional import duties for products set out in Annex A to 84 FR 54245, and the technical adjustments in the USTR FRN pending publication apply to merchandise entered for consumption, or withdrawn from warehouse for consumption, on or after 12:01 a.m. eastern daylight time on October 18, 2019. The Section 301 duties assessed under this trade remedy vary based on product and country. Further, the additional duties provided for in the new Harmonized Tariff Schedule of the United States (HTSUS) subheadings established by Annex A to this notice apply in addition to all other applicable duties, fees, exactions, and charges.

For listed merchandise from the subject countries of origin entered for consumption, or withdrawn from warehouse for consumption, on or after 12:01 a.m. eastern daylight time on October 18, 2019, report the Chapter 99 HTSUS number and duty rate in the attached table.

CHAPTER 98 AND CHAPTER 99

Products of Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, or the United Kingdom that are subject to this Section 301 trade remedy and that are eligible for temporary duty exemptions or reductions under HTS Heading 9902 shall be subject to the additional duties imposed by subheadings 9903.89.05 through 9903.89.50. Any such duty exemption or reduction shall apply only to the chapters 1 through 97 of the HTSUS.

The additional duties imposed by subheadings 9903.89.05 through 9903.89.50 do not apply to goods for which entry is properly claimed under a provision of chapter 98 of the HTSUS, except for goods entered under subheadings 9802.00.40, 9802.00.50 and 9802.00.60 and heading 9802.00.80. For subheadings 9802.00.40, 9802.00.50 and 9802.00.60, the additional duties apply to the value of repairs, alterations or processing performed, as described in the applicable subheading, in one or more of the following countries: Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, or the United Kingdom. For heading 9802.00.80, the additional duties apply to the value of the article, less the cost or value of such products of the United States, as described in heading 9802.00.80.

CHAPTER 98 AND CHAPTER 99 FILING INSTRUCTIONS

When submitting an entry summary in which a heading or subheading in Chapter 98 and/or 99 is claimed on imported merchandise, the following instructions will apply for the order of reporting the HTS on an entry summary line.

HTS SEQUENCE:

Chapter 98 (if applicable)

Chapter 99 number(s) for additional duties (if applicable),

For trade remedies:

First report the Chapter 99 HTS for Section 301 Goods of China OR Chapter 99 HTS for 301 Goods of Certain EU Countries (Large Civil Aircraft) (if applicable),

Followed by the Chapter 99 HTS for Section 232 or 201 duties (if applicable),

Followed by the Chapter 99 HTS for Section 201 or 232 quota (if applicable),

Chapter 99 number(s) for REPLACEMENT duty or other use (i.e., MTB or other provisions) (if applicable),

Chapter 99 number for other quota (not covered by #3) (if applicable),

Chapter 1 to 97 Commodity Tariff

Antidumping/Countervailing Duty (AD/CVD)

Products of Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden or the United Kingdom that are described in any of subheading 9903.89.05 through 9903.89.50 and classified in one of the subheadings enumerated in such subheadings, shall continue to be subject to antidumping, countervailing, or other duties (including duties imposed by other provisions of subchapter III of this chapter and safeguard duties set forth in provisions of subchapter IV of this chapter), fees, exactions and charges that apply to such products, as well as to the additional imposed herein.

FOREIGN TRADE ZONES

Any product listed in Annex A, except any product that is eligible for admission under ‘domestic status’ as defined in 19 CFR 146.43, which is subject to the additional duty imposed by this determination, and is admitted into a U.S. foreign trade zone on or after 12:01 a.m. eastern daylight time on October 18, 2019, only may be admitted as ‘privileged foreign status’ as defined in 19 CFR 146.41. Such products will be subject upon entry for consumption to any ad valorem rates of duty or quantitative limitations related to the classification under the applicable HTSUS subheading.

FOR FURTHER INFORMATION

For more information related to the Large Civil Aircraft Section 301 EU-WTO dispute, please refer to 84 FR 54245, issued October 9, 2019 and the technical adjustments included in Federal Register Public Inspection Document Number 2019-22902 at https://www.federalregister.gov/documents/2019/10/18/2019-22902/technical-adjustments-to-section-301-action-enforcement-of-us-wto-rights-in-large-civil-aircraft .

Questions related to Section 301 entry filing requirements should be emailed to traderemedy@cbp.dhs.gov. Questions from the importing community related to entry acceptance and rejection issues should be referred to their Client Representative. Attachment: Section 301-Large Civil Aircraft