On August 5, 2019, the Trump Administration labeled China a “currency manipulator,” in a move that many called symbolic. From a trade remedies perspective, the decision could mean increased duties on products subject to countervailing duty orders, adding pressure and expense to already burdened imports.

Currency manipulation refers to the practice of weakening one’s own currency to improve trade balances by making exports cheaper and imports more expensive. During the 2016 presidential campaign, then candidate Trump accused China of manipulating the yuan on multiple occasions, but to date the United States has not imposed a punishment based on these allegations. Indeed, the US Treasury Department has repeatedly found in recent years that China is not manipulating its currency. The next report by Treasury is due in October 2019. In the event China is found to be a currency manipulator this time, the Commerce Department is posed to take action in the form of additional import duties.

US Commerce Department Announces New Proposal:

The US Commerce Department announced a significant change to its regulations that would allow it to identify undervalued currency as an unfair subsidy. This step would allow Commerce to apply countervailing duties against imports covered by a relevant order. The proposal is unique under US trade remedies practices, in that it sets out a process under which Commerce would consult with the US Treasury Department to make a determination on whether a foreign government has manipulated its own currency in a way that may provide an unfair advantage to exporters when they sell their goods to the United States. If the consultation process indicates that there has been currency manipulation, then Commerce would be authorized to proceed with a calculation of the amount of the benefit – which ultimately establishes the duty rate that will apply to imports.

Commerce set forth its method for calculating the unfair subsidy rate as follows:

- “In determining whether a benefit is conferred when a firm exchanges United States dollars for the domestic currency of a country under a unified exchange rate system, the Secretary normally will consider a benefit to be conferred when the domestic currency of the country is undervalued in relation to the United States dollar.”

- Commerce proposed the use of “an equilibrium ‘real effective exchange rate,” or “REER,” to be the benchmark for determining whether a currency undervaluation has actually conferred a benefit to a foreign exporter. Commerce defines REER as an exchange rate that “would lead to an appropriate level for external balance over the medium term.”

- The process: under the current proposal, Commerce would fist measure the extent of the undervaluation in comparison with the REER and then identify the bilateral U.S. dollar exchange rate that would have come to pass over a certain period of time had the undervaluation not occurred. The difference is the “benefit” conferred for subsidy purposes.

Commerce noted that its proposal identified one option for treating undervalued currency as a subsidy, and it invited parties to comment on other possible options.

Beijing Rejects the Charge:

In early August, the People’s Bank of China responded almost immediately to the currency manipulation charges by arguing that the label is inconsistent with the quantitative criteria set out by the US’ own Treasury Department. In a statement, the Bank stated:

“Recent RMB depreciation since the beginning of August has been driven and determined by market forces and reflects shifts in market dynamics and volatilities in global foreign exchange markets amid global economic developments and escalating trade frictions. The PBC has been committeed to maintaining the RMB exchange rate basically stable at an equilibrium and adaptive level, and our efforts have been widely recognized by international partners.”

Given the recent US Treasury Department reports that have confirmed that China is not currently manipulating its currency, it seems that China will have several arguments available in both the policy context and in litigation – whether in US federal courts or in World Trade Organization (“WTO”) dispute settlement.

What Should Companies Do?

- For purchasers, importers, or foreign producers/exporters of products covered by countervailing duty orders – carefully monitor upcoming deadlines for administrative reviews and assess any new subsidy allegations that relate to currency.

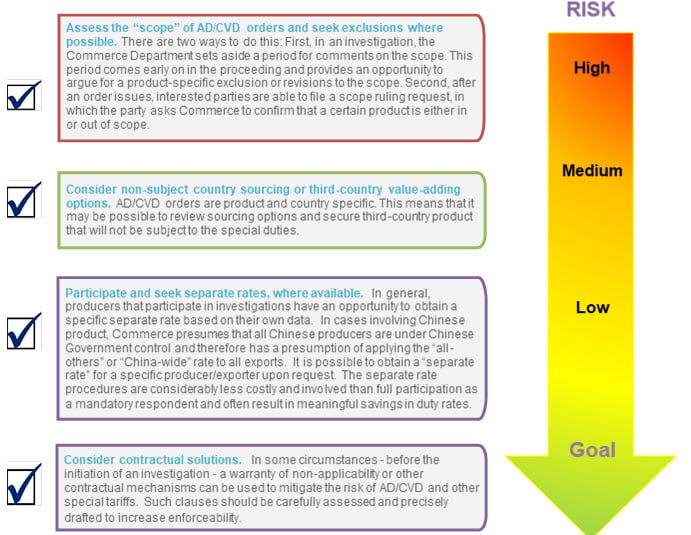

- US importers of Chinese product – whether your imports are currently covered by an active antidumping/countervailing duty order or not, recognize the risk associated with this new basis to increase duties. Assess duty mitigation strategies, including alternative sources of supply. [See chart below]

- Consider the WTO implications – any US measures taken against China or other trade partners to impose duties for “currency manipulation” will run into potentially fatal issues under multilateral trade agreements. If the measures are held inconsistent with US commitments, then the WTO could authorize China to retaliate, further escalating the trade tensions.

For more information, please contact the authors: Kevin O’Brien, Christine Streatfeild, B. Thomas Peele III.

AD/CVD Risk Mitigation Strategies:

4 Ways to Reduce the Risk of Significant Duties