With the ratification of the Comprehensive and Progressive Agreement for the Trans-Pacific Partnership (CPTPP) by Mexico, Japan and Singapore, and the expectation that other parties will follow, we anticipate the agreement will enter into force by early next year. Although the CPTPP differs from the Trans-Pacific Partnership (TPP) due to the suspension of 22 provisions, most chapters of the new agreement remain untouched. One of those is Chapter 3: Rules of Origin and Origin Procedures. Certificate of Origin, CPTPP, verification, ASEAN, ATIGA, Form D, self-certification, trade, customs, prepare, free trade agreement

As we get closer to entry into force, businesses should prepare to take advantage of the reduced tariffs and take steps to prepare for the new origin procedures. Under the CPTPP, the certificate of origin requirements are less onerous, do not require a specific form, require fewer data elements, and allow for self-certification. Many businesses will find this to be good news, and the simplified process is likely to facilitate trade among the eleven parties to the agreement. However, in order to substantiate the claims, businesses should start preparing for the new requirements and put in place procedures, including recordkeeping requirements, to provide sufficient support for preferential duty claims made under the CPTPP.

Self-certification and verification requirements

The rules of origin under the CPTPP differ from the usual origin procedures that are utilized in the Asia Pacific region under the existing ASEAN agreements. For duty preference claims, the ASEAN agreements most often require a government-issued certificate of origin. Under the CPTPP, importers, exporters and producers may “self-certify” or have the importer, exporter or producer sign the certificate of origin.

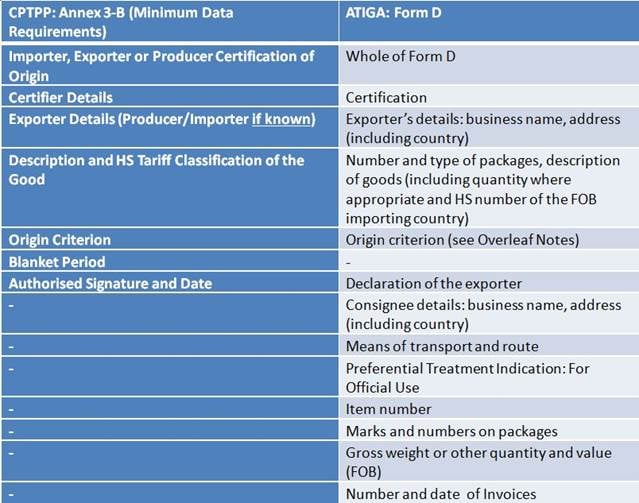

Additionally, the CPTPP self-certified certificate requires fewer data elements than what is typically required under the ASEAN agreements. Below is a chart that compares the data elements of the ASEAN Trade in Goods Agreement (ATIGA) Form D to the CPTPP list of minimum data elements found in Chapter 2, Annex 3-B.

With the benefit of self-certification and fewer data elements comes some additional risk and exposure. This is because the CPTPP also provides for certificate of origin verification procedures, similar to an audit. So while the self-certification may be much more efficient and streamlined, businesses will have to ensure internal compliance procedures are in place to verify preferential claims and maintain sufficient records.

What to expect under the CPTPP and lessons from KORUS

Article 3.27 of Chapter 3 states that an importing party may “conduct a verification of any claim for preferential tariff treatment by one or more of the following”:

- a written request for information from the importer of the good

- a written request for information from the exporter or producer of the good

- a verification visit to the premises of the exporter or producer of the good

- and other procedures as may be decided by the importing party and the party where the exporter or producer is located. [There are additional verification procedures for textile and apparel.]

The verification provisions provide for broad authority for requests for information as well as on site visits of the importer, exporter and producer. The language is very similar to the text of the Korea-United States Free Trade Agreement (KORUS). And, under KORUS, we know the preferential duty claims often attract rigorous verification. We may see similar verification activity under the CPTPP, especially in countries that count on customs duty as a significant source of government revenue.

How can business prepare?

To prepare for potentially broad verifications, we recommend that businesses do the following:

- ensure that supply contracts with importers, exporters and producers include language addressing certificate of origin signature requirements, such as clauses that require the counterparty to accurately provide the minimum data elements as well as sufficient documentation to support compliance with the country of origin requirements;

- conduct due diligence on importers, exporters and producers to ensure that the certifying parties maintain adequate manufacturing documents and production records;

- ensure that the exporter or producer can and will produce all information relied on for the certification;

- ensure importers maintain records for the claims; and

- when an importer certifies, ensure the importer maintains sufficient documentation to demonstrate country of origin.

Stay tuned for additional blog posts on how you can prepare for the CPTPP. For additional information, please contact the authors, Fred Burke, Jon Cowley, or Kana Itabashi.